Data Security - It's a joke, until it's your info.

Why shouldn’t you send me unsecured documents? I’ll roast you online.

So this morning, a mortgage broker sent me a stranger’s trust document. This afternoon, a real estate title agency asked for my social security number, address, and full name by email. By 2 pm I had lost my cool. These companies are responsible for guarding their client data and doing their jobs without risking your identity with a careless click. My identity isn’t worth it. Unfortunately, Molly didn’t seem bothered that she had sent me the info of a lady in Ohio and that I could see her details, full name, address, and more. Thanks, Molly.

I asked both companies if they had secure portals, and both replied, that they did in fact have these tools. Neither had sent me the link or invite to use them. They just weren’t using them! WTF?

You wouldn’t leave your storefront unlocked overnight, would you? The same care should go into protecting your customers’ sensitive data.

How is a portal different than an email? If Molly had used her portal, she could have deleted or recalled the document and cut off my access. But now that it’s in my email, she can’t get it back. She’s got to rely on me deleting it. I think we all know a creep who wouldn’t delete it. Someone who would be on Facebook looking you up in a second.

That’s where the Gramm-Leach-Bliley Act (GLBA) Safeguards Rule comes in. It’s not just for banks or big corporations—it applies to a wide range of entities, including some you wouldn’t expect. And on June 9 of 2024, further rules went into place, clearly neither of these places are following them.

Here’s the good news: compliance isn’t as overwhelming as it sounds. By the end of this post, you’ll know what the Safeguards Rule is, why it matters, and the simple steps to safeguard your business and customers. You’re small business will be in better shape than these 2 so-called professional companies.

What Is the Gramm-Leach-Bliley Act Safeguards Rule?

The GLBA Safeguards Rule is part of a U.S. law designed to ensure businesses handle sensitive customer information responsibly. It applies to a broad array of entities engaged in financial activities, including:

1. Traditional Financial Institutions:

Banks

Credit unions

Insurance companies

Investment advisors

2. Non-Traditional Entities Engaged in Financial Activities:

Mortgage lenders and closing agents

Financial advisors, lawyers, tax pros

ATM operators, payment processors

Debt collectors

Car rental companies

Courier services

Credit reporting companies

3. Educational Institutions:

Universities and colleges that handle financial activities such as student loans.

4. Other Businesses:

Companies that receive personal information from financial institutions.

Organizations outside the U.S. offering financial services to individuals within the country.

In short, the GLBA applies to any institution "significantly engaged" in providing financial products or services, such as lending, brokering, financial advising, or insurance.

💡 Pro Tip: If your business collects or processes customer financial data in any way, it’s worth double-checking whether the GLBA applies to you. Even if you are just a small business but you have a big client list, or you keep client payment methods on file, you need to check yourself.

Why the GLBA Safeguards Rule Matters for Small Businesses

Imagine this: A small tax preparer skipped encryption to save costs. A data breach exposed hundreds of customers’ personal details, resulting in lawsuits, lost trust, and financial ruin. Or perhaps a mortgage broker sent a trust document to the wrong person, exposing someone’s details to a stranger. Unfortunately, scenarios like this are more common than you’d think:

60% of small businesses close within six months of a major data breach.

Data breaches cost businesses an average of $4.35 million globally in 2022.

Beyond the risks, protecting customer data builds trust, which can set your business apart. When customers know their information is safe, they’re more likely to stick with you.

What’s New in the Updated Safeguards Rule?

Here’s what changed with the most recent updates to the Safeguards Rule:

Encryption Requirements: Businesses must encrypt all sensitive customer information, both in transit and at rest.

Multi-Factor Authentication (MFA): Passwords alone are no longer enough. MFA adds an extra layer of security.

Breach Notifications: If a data breach affects 500+ customers, you must notify the FTC within 30 days.

💡 Keep in mind: These changes are already enforceable, so don’t wait to act. The penalties are also huge and can be loss of licenses, $100,000 fine, and/or 5 years in jail.

How to Make Compliance Simple and Stress-Free

You don’t need a massive IT budget to comply. Follow these three steps to keep things manageable:

1. Develop a Written Security Plan

Think of this as your business’s playbook for protecting customer data. Here’s how:

Identify what types of data you collect.

Determine how and where you store it.

Create a plan to respond to breaches, including FTC notification requirements.

2. Use Affordable Tools

Compliance tools don’t have to break the bank. Here are some recommendations:

Encryption: Tools like BitLocker (Windows) or FileVault (Mac).

MFA: Duo Security offers user-friendly, low-cost solutions.

The Google Authenticator App is free.Use the Security Settings on your Email. You can encrypt emails on Google and other email services offer custom security settings.

Secure Portals: Smartvault and Encyro are easy ways to offer client file sharing.

💡 Helpful tip: Many cloud services include built-in encryption—check your current software for this feature.

3. Train Your Team & Yourself

Make training engaging. Compare phishing emails to “too-good-to-be-true” spam offers or use role-playing scenarios to teach employees how to spot risks. It’s a bit more complicated than “don’t click any links”, but that’s a good start. Take care to choose software vendors who know what they are doing to host your CRM and payment details. Ask your insurance agent what your responsibilities are.

Actionable Checklist to Stay Compliant

Here’s a quick compliance checklist:

✅ Encrypt all sensitive customer data.

✅ Implement multi-factor authentication for logins.

✅ Draft a written information security plan.

✅ Train your employees and yourself on data security best practices.

✅ Set up a breach notification protocol.

✅ Hire an IT consultant if you need more support.

Conclusion: It’s not that hard to get this right.

Protecting customer data isn’t just about avoiding fines—it’s about building trust that keeps your customers coming back.

Start small. A written plan and a few affordable tools can go a long way. And if you need guidance, we’re here to help you secure your business for the future.

💡 Contact us for a consultation on GLBA compliance and data security solutions.

New Small Business Tax School - New Matchmaking Connection!

Today I’m talking about 2 new big things we’ve created to grow our impact and network. Connection Requests and Small Business Tax School.

With tax season approaching, we’ve been busy planning and working on how to make things better for us inside the office but also for our clients. And we’ve been realizing that we just can’t service everyone who needs a tax preparer. We have to focus.

With that giant realization, we’ve created two new things to help us answer your questions, provide better service, and connect people to legit, trusted pros, even if we can’t serve them ourselves.

Small Business Tax School is our new free community, where we’ll post all of our resources, worksheets, checklists, interviews, expert interviews, and business consulting and coaching. When we answer a question, we’ll share it here so that when one learns, all learn. This will help us serve more people faster by being more available in one specific place. It’s impossible to be in all the places simultaneously, and it’s hard only to help one person per hour when you know more people need you and you have a pile of work to do on the desk behind you…… So hop in and get in on the ground floor. It will grow and expand based on what you community wants, so make sure you get your feedback in there.

Our second creation is an offer to connect you with other tax pros and accounting firms who work like us and believe in the power of collaborative and purposeful work. We know we can’t help everyone and are focused on serving our niche because that’s what we do best. But we know many people want to work with someone like us. So we’ve made a quick little form available right here, and when you fill it out, we’ll do the heavy lifting to search our network and then get you a short list of pros who are interested in serving you and are taking new clients just like you. This works for bookkeepers and tax pros alike. So click on our Connection Request and request a Connection!

We hope that these two things can help us serve our clients and community better.

If you are a tax pro or bookkeeper who wants to be considered part of our Connection Network, let us know!

If you hate our new ideas, let me know, too. I’m curious to hear how people think we should deal with the shortage of tax pros, retiring accountants, and an overall deluge of work and demand, especially if you think we’re doing it wrong. I’d like to hear what you’d do. But be careful; we’re hiring, so you may just get asked to join the team.

Email me at stephanie@steinkeandcompany.com

Avoid the Trap: Smart Strategies to Prevent Costly Penalties from Underpaying Estimated Taxes

Underpayment penalties are a common concern for taxpayers, and many are unaware of how substantial they can be. These penalties are assessed by the Internal Revenue Service (IRS) when taxpayers fail to pay enough of their tax liability through withholding or estimated tax payments throughout the tax year. The interest rate for underpayments has been 8% per year, compounded daily, since October 1, 2023 and at least through June 30, 2024. That is up from 3% just two or three years ago.

Understanding underpayment penalties and the strategies to avoid them can save you from unnecessary financial stress and penalties. This article will delve into the intricacies of underpayment penalties and offer guidance on how to navigate these waters effectively.

Understanding Underpayment Penalties - Underpayment penalties are essentially the IRS's way of ensuring that taxpayers are paying their taxes on a quarterly basis rather than waiting until the tax filing deadline. The IRS requires that you pay at least 90% of your current year's tax liability or 100% of the tax shown on your return for the previous year (110% if you're considered a higher-income taxpayer) throughout the year. If you fail to meet these thresholds, you may be subject to the underpayment penalty. Think of it this way: the IRS is effectively charging you interest on the tax money you kept instead of sending it to the government.

The penalty is calculated on a quarterly basis, meaning that if you underpaid in any given quarter, you might be penalized for that quarter even if you overpaid in another. The rate of the penalty is determined by the IRS and can vary from quarter to quarter. For self-employed individuals or those without sufficient withholding, estimated tax payments are a critical tool in managing tax liability and avoiding underpayment penalties. You would think that a quarter of the year would be 3 months, but for the purpose of this calculation, the “quarters” are uneven and cover January – March (3 months), April and May (2 months), June, July and August (3 months) and finally the last 4 months of the year.

De Minimis Exception - The de minimis exception is one way to avoid underpayment penalties. If your total tax liability minus your withholdings and tax credits is less than $1,000, you won't be subject to underpayment penalties. This rule is particularly beneficial for taxpayers who have a relatively small tax liability.

Safe Harbor Payments - Safe harbor payments are essentially benchmarks set by the IRS that, if met, protect taxpayers from underpayment penalties, regardless of their actual tax liability for the year. These benchmarks are designed to ensure that taxpayers pre-pay a minimum amount of their tax obligation throughout the year, either through withholding or estimated tax payments.

The general rule for safe harbor payments requires taxpayers to prepay the lesser of 90% of the current year's tax or 100% of the previous year's tax. However, for those with an adjusted gross income (AGI) over $150,000 ($75,000 if married filing separately), the rules tighten. These individuals must pay the lesser of 90% of the current year's tax or 110% of the previous year's tax to qualify for this safe harbor. Thus, the safe harbor that works for any eventuality is 110% of the previous year's tax liability. In addition, if you had no tax liability in the prior year, then you are exempt from an underpayment penalty.

Since these pre-payments consist of both withholding and estimated tax payments, the timing of these payments is also critical for payments to qualify for the safe harbor penalty exception. Estimated tax payments are due in four installments: April 15, June 15, September 15, and January 15 of the following year, approximately 2 weeks after the end of the “quarters” noted above. If any of these dates falls on a Saturday, Sunday, or legal holiday, the due date will be the next business day. Caution: Some states have different estimated payments dates and, in some cases, amounts for state estimated payments.

Withholding - Unlike estimated payments, withholding is considered paid evenly throughout the year, regardless of when it occurs. This can be particularly useful for taxpayers who realize they may fall short of their safe harbor requirements as the year progresses and boost their withholding by one means or another depending upon the increase required.

An employee can increase their withholding for the balance of the year by providing their employer with a modified W-4 form that will cause the employer to increase withholding for the balance of the year.

Where the increased withholding need is discovered closer to the end of the year, a cooperative employer might be willing to withhold a lump sum amount.

10% is the default withholding rate for nonperiodic withdrawals from traditional IRA accounts when you fail to provide a Form W-4R to the payer that indicates your desired withholding rate (0% - 100%). Thus by submitting a Form W-4R, or a revised one, to the payer of the IRA, requesting a higher withholding rate, additional withholding can be achieved. Where you are not employed (or even if you are), you can create more tax withholding by taking a distribution and then rolling the distribution amount back into the traditional IRA or a qualified retirement plan within the statutory 60-day time frame. To achieve this strategy you will need to make up for the withholding with other funds when making the rollover and make sure you did not have another rollover in the prior 12 months since taxpayers are only allowed one IRA rollover in a 12-month period.

Form W-4R is also used to advise payers of an eligible rollover distribution from an employer retirement plan of the desired withholding rate if it is other than the default rate of 20%.

Form W-4P should be completed to have payers withhold the correct amount of federal income tax from the taxable portion of a periodic pension, annuity (including commercial annuities), profit-sharing and stock bonus plan, or IRA payments. Periodic payments are made in installments at regular intervals (for example, annually, quarterly, or monthly) over a period of more than 1 year.

Calculating the Penalty – If you file your return, owe more than $1,000 and don’t meet an exception, the IRS will compute the underpayment penalty and bill you for it. However, IRS Form 2210 (2210-F for farmers and fishers) can be used to calculate the required annual payment and determine if you have underpaid in any quarter of the tax year. The form considers the amount of tax owed, estimated tax payments made, and any withholding. It then calculates the penalty based on the underpayment for each quarter until the due date of the tax return or until the underpayment is paid, whichever comes first.

If your income varies significantly throughout the year, the annualized income installment method can help reduce or eliminate underpayment penalties. This method allows you to calculate your tax liability and corresponding estimated payments based on your actual income for each quarter, rather than assuming an even income distribution throughout the year.

Farmers and Fishermen - There are special estimated tax requirements for farmers and fishermen. Farmers and fishermen, with at least two-thirds of their gross income for the prior year or the current year from farming or fishing, have two options:

They may pay all their estimated tax by January 15th (which is the 4th quarter due date for estimated taxes), or

They can file their tax return on or before March 1st and pay the total tax due at that time.

The required estimated tax payment for farmers and fishermen is the lesser of:

66 2/3% of the current year’s tax, or

100% of the prior year’s tax.

These provisions are designed to accommodate the unique income patterns of farmers and fishermen, who may not have steady income throughout the year and often realize the bulk of their income at specific times of the year.

Navigating the complexities of underpayment penalties requires a proactive approach to tax planning and payment. By understanding the rules and utilizing strategies such as adjusting withholdings, making estimated tax payments, and taking advantage of the safe harbor rule and the de minimis exception, taxpayers can avoid the financial sting of underpayment penalties. Remember, the goal is to manage your tax liability throughout the year effectively, so you're not caught off guard come tax season.

If you're unsure about your tax situation, please contact this office for personalized advice and peace of mind.

Avoid the Trap: Smart Strategies to Prevent Costly Penalties from Underpaying Estimated Taxes

Underpayment penalties are a common concern for taxpayers, and many are unaware of how substantial they can be. These penalties are assessed by the Internal Revenue Service (IRS) when taxpayers fail to pay enough of their tax liability through withholding or estimated tax payments throughout the tax year. The interest rate for underpayments has been 8% per year, compounded daily, since October 1, 2023 and at least through June 30, 2024. That is up from 3% just two or three years ago.

Understanding underpayment penalties and the strategies to avoid them can save you from unnecessary financial stress and penalties. This article will delve into the intricacies of underpayment penalties and offer guidance on how to navigate these waters effectively.

Understanding Underpayment Penalties - Underpayment penalties are essentially the IRS's way of ensuring that taxpayers are paying their taxes on a quarterly basis rather than waiting until the tax filing deadline. The IRS requires that you pay at least 90% of your current year's tax liability or 100% of the tax shown on your return for the previous year (110% if you're considered a higher-income taxpayer) throughout the year. If you fail to meet these thresholds, you may be subject to the underpayment penalty. Think of it this way: the IRS is effectively charging you interest on the tax money you kept instead of sending it to the government.

The penalty is calculated on a quarterly basis, meaning that if you underpaid in any given quarter, you might be penalized for that quarter even if you overpaid in another. The rate of the penalty is determined by the IRS and can vary from quarter to quarter. For self-employed individuals or those without sufficient withholding, estimated tax payments are a critical tool in managing tax liability and avoiding underpayment penalties. You would think that a quarter of the year would be 3 months, but for the purpose of this calculation, the “quarters” are uneven and cover January – March (3 months), April and May (2 months), June, July and August (3 months) and finally the last 4 months of the year.

De Minimis Exception - The de minimis exception is one way to avoid underpayment penalties. If your total tax liability minus your withholdings and tax credits is less than $1,000, you won't be subject to underpayment penalties. This rule is particularly beneficial for taxpayers who have a relatively small tax liability.

Safe Harbor Payments - Safe harbor payments are essentially benchmarks set by the IRS that, if met, protect taxpayers from underpayment penalties, regardless of their actual tax liability for the year. These benchmarks are designed to ensure that taxpayers pre-pay a minimum amount of their tax obligation throughout the year, either through withholding or estimated tax payments.

The general rule for safe harbor payments requires taxpayers to prepay the lesser of 90% of the current year's tax or 100% of the previous year's tax. However, for those with an adjusted gross income (AGI) over $150,000 ($75,000 if married filing separately), the rules tighten. These individuals must pay the lesser of 90% of the current year's tax or 110% of the previous year's tax to qualify for this safe harbor. Thus, the safe harbor that works for any eventuality is 110% of the previous year's tax liability. In addition, if you had no tax liability in the prior year, then you are exempt from an underpayment penalty.

Since these pre-payments consist of both withholding and estimated tax payments, the timing of these payments is also critical for payments to qualify for the safe harbor penalty exception. Estimated tax payments are due in four installments: April 15, June 15, September 15, and January 15 of the following year, approximately 2 weeks after the end of the “quarters” noted above. If any of these dates falls on a Saturday, Sunday, or legal holiday, the due date will be the next business day. Caution: Some states have different estimated payments dates and, in some cases, amounts for state estimated payments.

Withholding - Unlike estimated payments, withholding is considered paid evenly throughout the year, regardless of when it occurs. This can be particularly useful for taxpayers who realize they may fall short of their safe harbor requirements as the year progresses and boost their withholding by one means or another depending upon the increase required.

An employee can increase their withholding for the balance of the year by providing their employer with a modified W-4 form that will cause the employer to increase withholding for the balance of the year.

Where the increased withholding need is discovered closer to the end of the year, a cooperative employer might be willing to withhold a lump sum amount.

10% is the default withholding rate for nonperiodic withdrawals from traditional IRA accounts when you fail to provide a Form W-4R to the payer that indicates your desired withholding rate (0% - 100%). Thus by submitting a Form W-4R, or a revised one, to the payer of the IRA, requesting a higher withholding rate, additional withholding can be achieved. Where you are not employed (or even if you are), you can create more tax withholding by taking a distribution and then rolling the distribution amount back into the traditional IRA or a qualified retirement plan within the statutory 60-day time frame. To achieve this strategy you will need to make up for the withholding with other funds when making the rollover and make sure you did not have another rollover in the prior 12 months since taxpayers are only allowed one IRA rollover in a 12-month period.

Form W-4R is also used to advise payers of an eligible rollover distribution from an employer retirement plan of the desired withholding rate if it is other than the default rate of 20%.

Form W-4P should be completed to have payers withhold the correct amount of federal income tax from the taxable portion of a periodic pension, annuity (including commercial annuities), profit-sharing and stock bonus plan, or IRA payments. Periodic payments are made in installments at regular intervals (for example, annually, quarterly, or monthly) over a period of more than 1 year.

Calculating the Penalty – If you file your return, owe more than $1,000 and don’t meet an exception, the IRS will compute the underpayment penalty and bill you for it. However, IRS Form 2210 (2210-F for farmers and fishers) can be used to calculate the required annual payment and determine if you have underpaid in any quarter of the tax year. The form considers the amount of tax owed, estimated tax payments made, and any withholding. It then calculates the penalty based on the underpayment for each quarter until the due date of the tax return or until the underpayment is paid, whichever comes first.

If your income varies significantly throughout the year, the annualized income installment method can help reduce or eliminate underpayment penalties. This method allows you to calculate your tax liability and corresponding estimated payments based on your actual income for each quarter, rather than assuming an even income distribution throughout the year.

Farmers and Fishermen - There are special estimated tax requirements for farmers and fishermen. Farmers and fishermen, with at least two-thirds of their gross income for the prior year or the current year from farming or fishing, have two options:

They may pay all their estimated tax by January 15th (which is the 4th quarter due date for estimated taxes), or

They can file their tax return on or before March 1st and pay the total tax due at that time.

The required estimated tax payment for farmers and fishermen is the lesser of:

66 2/3% of the current year’s tax, or

100% of the prior year’s tax.

These provisions are designed to accommodate the unique income patterns of farmers and fishermen, who may not have steady income throughout the year and often realize the bulk of their income at specific times of the year.

Navigating the complexities of underpayment penalties requires a proactive approach to tax planning and payment. By understanding the rules and utilizing strategies such as adjusting withholdings, making estimated tax payments, and taking advantage of the safe harbor rule and the de minimis exception, taxpayers can avoid the financial sting of underpayment penalties. Remember, the goal is to manage your tax liability throughout the year effectively, so you're not caught off guard come tax season.

If you're unsure about your tax situation, please contact this office by email or your own tax professional for personalized advice and peace of mind.

Many Taxpayers Will See Smaller Refunds This Year

Congress has for years used the tax return as a means of providing benefits to taxpayers in need and incentives to stimulate activities in business, as well as addressing environmental issues. So when COVID-19 hit, Congress and many state governments provided tax benefits to help citizens through the pandemic. Because the COVID pandemic-related benefits have come to an end, your tax refunds may be smaller this year, and substantially smaller for many. The following is a rundown of some areas where decreases in federal tax benefits will affect taxpayers’ 2022 tax refunds.

Child Tax Credit:

2021 - Taxpayers with children enjoyed an enhanced and refundable tax credit of $3,000 per child under the age of 18 ($3,600 if under age 6) per child in 2021.

2022 – The credit has reverted to 2020 levels and the maximum credit for 2022 is $2,000 per qualifying child, of which the maximum refundable amount is $1,500 per child in certain situations. In addition, the credit only applies to children under the age of 17.

Non-refundable tax credits can only be used to offset tax liability and any excess is lost. On the other hand, a refundable credit offsets tax liability and any excess is refundable.

In addition, the child tax credit has always phased out for higher income taxpayers. For 2021 the phaseout thresholds were substantially increased as illustrated in the table. However, that increase was for 2021 only and the thresholds have reverted to 2020 levels for 2022.

Dependent Care Benefits: The tax code provides a tax credit to help working taxpayers that pay care expenses for their children and other qualifying individuals. The credit is a percentage of the dependent care expenses incurred, but those expenses are limited to specific amounts and the taxpayer’s income from working. The credit percentage also declines for higher income taxpayers.

2021 – The credit was fully refundable, and the credit was a flat 50% of the allowable expenses up to $8,000 for one and $16,000 for two or more qualified individuals. Thus the credit could be as much $4,000 for one and $8,000 for two or more qualified individuals. The 50% credit rate began to phase out when the taxpayer’s AGI reached $125,000, but the rate wasn’t reduced below 20%.

2022 – The credit is not refundable, and the credit rate ranges from a high of 35% to a low of 20% (see table) of the allowable expenses up to $3,000 for one and $6,000 for two or more qualified individuals.

Recovery Rebates - As a means of providing financial assistance to individuals during the COVID pandemic, Congress authorized Recovery Rebate Credits (also referred to as economic impact payments) for the 2020 and 2021 tax years.

2021 - The rebates, which generally were issued by the federal government during the year but which may have been claimed on the 2021 tax return, were:

$1,400 ($2,800 for joint filers)

$1,400 per dependent

2022 – There were no rebates

Employee Retention Credit – As the title implies, this is a credit whose purpose was to help employers retain employees on payroll even though the employer’s business was in decline because of COVID.

2021 – The payroll credit was 70% of qualified wages up to $10,000 per employee for any quarter 1/1/21 through 9/30/21 or 12/31/21 for Recovery Start-Ups.

2022 – There is no longer a credit for years after 2021.

As you can see there have been some significant reductions of tax benefits that can have a substantial impact on your refund for 2022. Please contact your tax preparer if you have questions or contact your employer to adjust your withholding to alter your refund for 2023.

Four Popular Platforms for Finding Gig Work

There was once a time when the only people who used the word “gig” were musicians chatting about a booking. Today, virtually every newspaper and magazine features the booming gig economy — or how to make the most of it — on a regular basis. Though the term generally refers to people who have taken leave of their full-time jobs, choosing instead to work as independent contractors, there are many who are participating on freelance platforms as a way to supplement their income.

No matter whether you’re considering entering this flexible, unpredictable world, you won’t be alone. Businesswire has reported that more than one in three professionals turned to freelancing during the COVID-19 pandemic, and even as businesses have reopened and people have returned to work, a recent Pew Research study found that 9% of Americans were involved in gig work and that 31% of those — roughly 3 percent of U.S. adults — did gig work as their main job.

Gig work has plenty of benefits, but it has its drawbacks too. The most obvious advantage is the flexibility of making your own hours and being your own boss. Drawbacks include the unpredictability of work, the lack of paid benefits, and having to pay self-employment taxes.

If you’re wondering whether gig work is right for you, you have plenty of options available. Platforms exist for people with specialized skills as well as for unskilled workers, drivers, and grocery pickers. To give you an idea of the opportunities available, we’ve assembled a list of some of the top platforms for finding gig work.

Freelancer – This site offers the opportunity to post a personal profile that highlights your skills and then to bid on jobs in over 1,800 categories. Employers post their job descriptions and review the profile posted by each worker whose skills match their needs. Payments are made in milestones. The site has a membership fee after the first month, with a variety of membership options available.

Instacart – Signing up to be a contractor for this delivery service means you become a personal shopper, picking out items based on clients’ orders and then delivering them, Instacart’s gig workers do most of their shopping for clients at specific big brand stores. Must have constant access to a smartphone and a vehicle and must be able to lift 50 pounds without accommodation. In addition to being paid based on the job itself, you also have the opportunity to earn tips.

TaskRabbit – TaskRabbit matches those who need help with odd jobs and errands with people with the skill to do them. Jobs can range from driving to a physician’s office to helping somebody move or assemble furniture. This last task was posted so frequently on the platform that it attracted the attention of furniture giant IKEA, which purchased the site in 2017 and now offers a TaskRabbit service option with their furniture purchases. Gig workers download the site’s app and are then notified when somebody in their area posts a job they may want to complete.

Care.com – This platform matches pet sitters, babysitters, tutors, housekeepers, and senior caretakers with those in need of their services. Signing up as a contractor on this site requires submitting to a background check in order to ensure the safety of those being cared for. Skills such as CPR or first aid certification are particularly valuable. This site does not take a percentage of earnings but does charge a membership fee.

The gig economy offers limitless options for earnings, regardless of what your skill levels are. If you choose to get involved, make sure that you understand all the financial ramifications: payments are made through third-party platforms and reported to the IRS, so it is important that you are including all freelance income on your tax return and paying quarterly estimated income tax on all earnings.

If you need assistance in calculating your taxes or advice on whether jumping into the gig economy is right for you, contact your tax preparer!

When to Hire a Fractional CFO

Every entrepreneur starts their company with their own vision of what the future holds. Maybe you thought you’d just work from a home office, managing every function and loving every minute of it. Maybe you always knew you were going to make it big and would need a suite of executives, a team of sales and marketing professionals, and a whole bunch of support staff to help the whole thing run like a clock. Whatever you anticipated, if you’ve gotten to the point where your books and your financial planning have gotten beyond your ability, it’s time to think about bringing on someone with more time and experience. While you may be tempted to hire a full-time CFO, there are many benefits to using the fractional CFO services offered by a bookkeeping or accounting firm.

Every growing business needs accurate and timely record-keeping and reporting. But if your needs have grown beyond basic bookkeeping and you need financial insights, accounting management, KPI tracking, and analysis, it’s time to hire a professional. In the past, businesses in your position have had little choice but to bring on a Chief Financial Officer. Today, an increasing number of successful entrepreneurs are recognizing that hiring a virtual CFO — also known as a fractional CFO — makes a great deal of sense. And you can easily access this service by contacting your professional.

A virtual CFO provides outsourced financial services at a fraction of the cost of a full-time employee’s salary. While every business is different and compensation can shift based on years of experience, geographic location, and the scope of the actual work, there’s no getting around the fact that the median salary paid to a Chief Financial Officer in the United States is $417,857. That’s a pretty big hit to take as a new expense, and that doesn’t count the outlay for benefits, bonuses, and associated costs starting with office space and equipment and going on from there.

While the services afforded by a full-time Chief Financial Officer would undoubtedly be valuable, most businesses have legitimate questions about whether the outlay of cash is worth the price. Now consider instead the option of using your CPA firm’s virtual CFO service. They have invested in bringing on professionals who possess all of the same knowledge and experience, but a fractional CFO service participates on a customized schedule to suit the needs of your company — and charges according to a much more reasonable contracted monthly fee, without the need to pay benefits, bonuses, or other expenses.

The difference between the two costs speaks for itself. But do you really get the same level of service? And how do you know that you’re ready or have a need for these services?

Most virtual CFOs were either previously employed as Chief Financial Officers but have chosen to step away from full-time work in favor of a more flexible schedule, or they were qualified to be Chief Financial Officers but opted for a different path. Whatever their specific background, your accounting firm has hired them because they have the exact qualifications needed to help small to mid-sized businesses valued between $1 million and $50 million that have needs beyond their management’s time or abilities and the interest in helping your business succeed.

To get a sense of whether your business needs a virtual CFO, consider these services that they offer and determine whether having them would help you achieve your goals:

A virtual CFO will provide you with financial strategies and projections to improve your operational performance

A virtual CFO will prepare in-depth monthly reports that incorporate all of the pertinent data about your organization and use them to identify what is either driving your growth or preventing it. Beyond simple preparation, they understand what information is important and has meaning and help you make good use of it.

A virtual CFO will manage your assets and monitor your cash flow to improve your overall standing, minimize risk, and optimize your profitability and ability to grow.

A virtual CFO will help you create a financial plan that you can follow. They will also track and measure whether you are sticking to the plan and whether it is helping or needs to be revised.

A virtual CFO will give you the gift of time. Rather than you struggling with these tasks or getting them done while sacrificing time that could be better spent on other things, a virtual CFO will take this task off of your to-do list, and do the job with ease and expertise.

ABLE Accounts and Individuals With Disabilities

Congress created Achieving Better Life Experience (ABLE) accounts in 2014. Prior to the creation of the ABLE accounts, individuals with disabilities who were eligible for Medicaid or federal Supplemental Security Income were limited to a maximum of $2,000 in assets, such as bank savings accounts. Now, disabled people are allowed to have up to $100,000 in one of these special accounts without jeopardizing their Medicaid or Supplemental Security Income.

ABLE accounts are available to individuals who became disabled before the age of 26. Once an account is established, anyone can contribute to it, provided that the sum of the contributions for the year does not exceed the annual gift tax exclusion, which is currently $16,000. These accounts are a less-expensive substitute for special needs trusts, which have significant administration costs. If contributions will exceed the annual gifting limit and $100,000 overall, a special needs trust will be required.

Each state must enact its own legislation to make ABLE accounts available in that particular state. As of August, 2022, only four states (Idaho, North Dakota, South Dakota, and Wisconsin) haven’t established ABLE programs. Even so, many states allow nonresidents to participate in their program, while some states only allow their own residents to participate in their ABLE account program.

ABLE accounts are fashioned after qualified state tuition programs, sometimes referred to as Section 529 plans. Although there is no tax benefit associated with contributions to the accounts, the earnings in the accounts accumulate tax-free and are also tax-free if used for qualified expenses such as:

Health care,

Education,

Employment training and support,

Assistive technology,

Personal support services,

Housing, and

Transportation expenses.

As a note of caution, qualified expenses do not include food, entertainment or vacations.

Only one account can be established for each beneficiary. The maximum annual contribution to an ABLE account is equal to the annual gift tax exemption amount, which for 2022 is $16,000.

Certain ABLE account beneficiaries who are employed may make an additional contribution to their ABLE account up to the lesser of:

The account beneficiary's compensation for the tax year, or

The poverty line for a one-person household. For 2022, this amount is $12,880 in the continental U.S., $16,090 in Alaska, and $14,820 in Hawaii.

Working ABLE account beneficiaries will only be able to take advantage of making additional contributions to their accounts through 2025.

ABLE accounts are designed so that certain employed ABLE account beneficiaries may be eligible to claim the nonrefundable saver's credit for a percentage of their contribution. To claim the saver's credit, an individual must:

Be at least 18 years old at the end of the tax year

Not be a dependent or a full-time student, and

Meet the income requirements.

The saver's credit is phased out for higher income taxpayers.

Families of a person with a disability may roll over funds from a 529 plan to the individual's ABLE account. Such rollovers count toward the annual contribution limit. For example, the $16,000 annual contribution limit would be met by parents contributing $10,000 to their child's ABLE account and rolling over $6,000 from a 529 plan to the same ABLE account.

If you have questions related to ABLE account contributions, the saver’s credit, or rollovers from qualified tuition plans, please call your local tax office.

Health Savings Accounts Fill Multiple Tax Needs

The Health Savings Account (HSA) is one of the most misunderstood and underused benefits in the Internal Revenue Code. Congress created HSAs as a way for individuals with high-deductible health plans (HDHPs) to save for medical expenses that are not covered by insurance due to the high-deductible provisions of their insurance coverage.

However, an HSA can act as more than just a vehicle to pay medical expenses; it can also serve as a retirement account. For some taxpayers who have maxed out their retirement-plan options an HSA provides them another resource for retirement savings – one that isn’t limited by income restrictions in the way that IRA contributions sometimes are.

Although the tax code refers to these plans as “health” savings accounts, they can also be used for retirement, as there is no requirement that the funds be used to pay medical expenses. Thus, a taxpayer can pay medical expenses with other funds, thus allowing the HSA to grow (through account earnings and further tax-deductible contributions) until retirement. In addition, should the need arise, the taxpayer can still take tax-free distributions from the HSA to pay medical expenses.

Withdrawals from an HSA that aren’t used for medical expenses are taxable and – depending on the taxpayer’s age – can be subject to penalty. Once a taxpayer has reached age 65, nonmedical distributions are taxable but not subject to a penalty (the same as for a traditional IRA once the IRA owner reaches age 59½). At the same time, regardless of age, a taxpayer can always take tax-free distributions to pay medical expenses.

Example: Henry is age 70 and has an HSA account from which he withdraws $10,000 during the year. He also has unreimbursed medical expenses of $4,000. Of his $10,000 withdrawal, $6,000 ($10,000 – $4,000) is added to Henry’s income for the year, and the other $4,000 is tax-free.

Eligible Individual – To be eligible for an HSA in a given month, an individual:

1. must be covered under a HDHP on the first day of the month;

2. must NOT also be covered by any other health plan (although there are some exceptions);

3. must NOT be entitled to Medicare benefits (i.e., generally must be younger than age 65); and

4. must NOT be claimed as a dependent on someone else’s return.

Any eligible individual – whether employed, unemployed or self-employed – can contribute to an HSA. Unlike with an IRA, there is no requirement that the individual have compensation, and there are no phase-out rules for high-income taxpayers. If an HSA is established by an employer, then the employee and/or the employer can contribute. Family members or any other person can also make contributions to HSAs on behalf of eligible individuals. Both employer contributions and employee contributions made via the employer’s cafeteria plan are excluded from the employee’s wage income. Employees who make HSA contributions outside of their employers’ arrangements are eligible to take above-the-line deductions – that is, they don’t need to itemize deductions – for those contributions.

The Monetary Qualifications for a HDHP –

Example – Family Plan Does Not Qualify: Joe has purchased a medical-insurance plan for himself and his family. The plan pays the covered medical expenses of any member of Joe’s family if that family member has incurred covered medical expenses of over $1,000 during the year, even if the family as a whole has not incurred medical expenses of over $2,800 during that year. Thus, if Joe’s medical expenses are $1,500 during the year, the plan would pay $500. This plan does not qualify as a HDHP because it provides family coverage with an annual deductible of less than $2,800.

Example – Family Plan Qualifies: If the coverage for Joe and his family from the example above included a $5,000 family deductible and provided payments for covered medical expenses only if any member of Joe’s family incurred over $2,800 of expenses, the plan would then qualify as a HDHP.

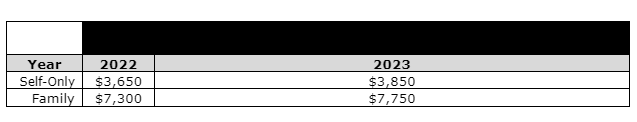

Maximum Contribution Amounts – The amounts that can be contributed are determined on a monthly basis and are calculated by dividing the annual amounts shown below by 12. Thus, if an individual’s health plan only qualified that person for an HSA for 6 months out of the year, then that person’s contribution amount would be half of the amount shown.

In addition to the amounts shown, an eligible individual who is age 55 and older can contribute an additional $1,000 per year.

How HSAs Are Established – An eligible individual can establish one or more HSAs via a qualified HSA trustee or custodian (an insurance company, bank, or similar financial institution) in much the same way that an individual would establish an IRA. No permission or authorization from the IRS is required. The individual also is not required to have earned income. If employed, any eligible individual can establish an HSA, either with or without the employer’s involvement. Joint HSAs between a husband and wife are not allowed, however; each spouse must have a separate HSA (and only if eligible).

If you have questions related to how an HSA could improve your long-term retirement planning or health coverage, please call your tax advisor.

What Is an Offer in Compromise?

Carrying long-term debt is a challenge, but when the money is owed to the government and you see no way to pay what you owe, it can be psychologically and emotionally debilitating. Some people think they can turn to bankruptcy, but that is not the case – bankruptcy specifically will not discharge tax debts. One of the few options available for settling tax debt is an IRS program called an Offer in Compromise, or OIC.

An OIC is not something that the IRS agrees to lightly. Roughly one in three applications for the program are approved. Still, it may be worth your time and effort to determine whether you qualify.

The Three Steps to Applying for an Offer in Compromise

Fill out IRS form 433-A and IRS form 656. If you plan to appeal the debt itself, you will also need to fill out IRS form 656-L.

Pay the nonrefundable application fee of $205. If your income is below the IRS low-income guidelines, the fee may be waived.

Propose paying an alternative amount to the IRS

This is a simple summary of a complex process that requires providing a significant amount of detail about your income and expenses. Though the form asks for a lot of information, the more diligent you are in demonstrating your inability to pay both your bills and your tax debt, the better your chances of being approved. It is also notable that 20% of the amount that you are offering to pay within your application must be included with your application in order for it to be considered. If your Offer in Compromise is rejected, the money will be applied toward your debt.

Eligibility for Applying for an OIC

Qualifying for an OIC is difficult in large part because the IRS has such strict rules about who is eligible to apply, as well as regarding what is needed to qualify.

Let’s look at the question of whether you can apply first. In order for your application to be accepted, you must make sure that you meet the following criteria:

You have answered all questions on the forms

You are current in having filed your tax returns

You must have submitted the $205 application fee or successfully had it waived

There must be at least one tax debt in your Offer in Compromise for which you have not received a bill

You must have submitted all of your estimated tax payments for the current year

You must not be in the midst of a bankruptcy proceeding

You must continue paying taxes and filing your tax returns while the IRS response to your offer is pending

Your case cannot have been sent to the Justice Department by the IRS

If any of these items are not in evidence, the IRS will send your application back for correction and resubmission.

Qualifying for an Offer in Compromise

The decision-making process that the IRS uses when considering taxpayers’ Offers in Compromise is an objective calculation, based on the financial information that’s been submitted to them, about whether and how much payment they are likely to be able to recover – a number referred to as “Reasonable Collection Potential.” That financial information considered includes all of your assets, your income, and your earnings potential as well as your cost of living and your debts. The IRS is extremely granular in their analysis, working to determine whether the amount of payment that you have suggested in your Offer in Compromise is less than, equal to, or greater than the Reasonable Collection Potential.

When the IRS accepts an Offer in Compromise, it is generally because they agree that your circumstances make it a hardship for you to pay, because there is a question about the actual amount that you owe, or because they believe that they’re never going to be able to collect the amount that you owe in full.

What the IRS Offer May Look Like

If the IRS decides to grant your request for an Offer in Compromise, they will do so in one of two ways. You will either be able to pay your debt off within five months or under a 24-month payment plan.

It is important to remember that under either of these plans, the IRS will already have received 20% of your offer amount and it will be considered the first payment under either of these payment options.

What Happens While You’re Waiting for the IRS to Respond

Upon receipt of your Offer in Compromise and all supporting documentation, all IRS collection activities will cease. If there are tax liens in place they will remain in place pending a decision and until you have made all payments if your offer is accepted. You will continue receiving any tax refunds that you are owed unless it is received via an amended return after an Offer in Compromise has been activated.

If your tax refund has been garnished and you are waiting for an IRS response to your Offer in Compromise proposal, you can request an offset bypass refund based on economic hardship that you will have to prove.

Rejection of your Offer in Compromise is appealable, and there are other options available — including installment plans or a “currently not collectible” status that can help you relieve extreme financial stress.

If you are struggling with tax debt that you believe you will simply be unable to pay, an Offer in Compromise may be the answer. For help identifying the best option available for your specific circumstances, contact your tax advisor!